A quick essay of the Silicon Valley Banking Crisis (and it is a crisis) and why does the collapse of one bank, one of the largest in the USA matter to you and me?

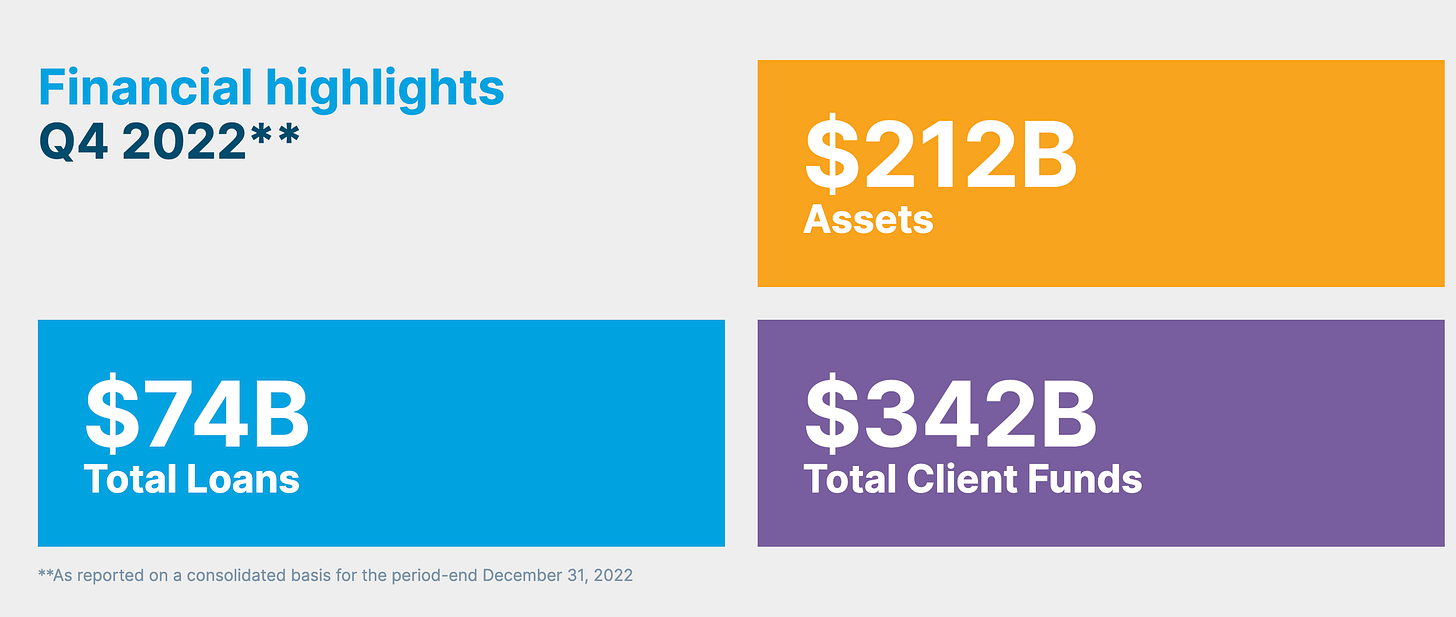

The graphic below is from the Silicon Valley bank’s website. I grabbed this just as the feces began hitting the fan on Friday. It is a quick synopsis of their 4th quarter outlook. One just has to add up assets and total loans - compared to client funds. Whoops - a little shortfall there! Without knowing the “whys and wherefores”, this pretty much sums up what went wrong.

But to break it down. In 2022, interest rates rose (mortgage rates currently have settled around 7% -higher for the average credit scored person). Of course, un-secured commercial loans actually have higher interest rates than that. So, people and companies stopped borrowing as much as they had been borrowing in year’s past, when interest rates were very low.

Anyway, Silicon Valley took in more money in client accounts than they could lend. So, they stuck that extra money in long-term government bonds, which back in early 2022 had extremely low earnings. Bonds whose interest earnings didn’t keep up with inflation. That money basically lost value. By my figures, maybe as much as 7-10% over the course of the year.

So they had a shortfall. Which generally, if they could keep that hidden from clients would be ok- if they could have course corrected (or so says various market analysts). This logic seems fishy to me, but that is what I have read.

Wind of their shortfall got out and they had a good old fashioned run. Rumor has it for instance, that Peter Thiel tried to transfer money on Thursday and couldn’t. He smelled a rat and immediately pulled all of the money he had stashed there out. He wasn’t the only one. Lots of large clients began withdrawing all of their money.

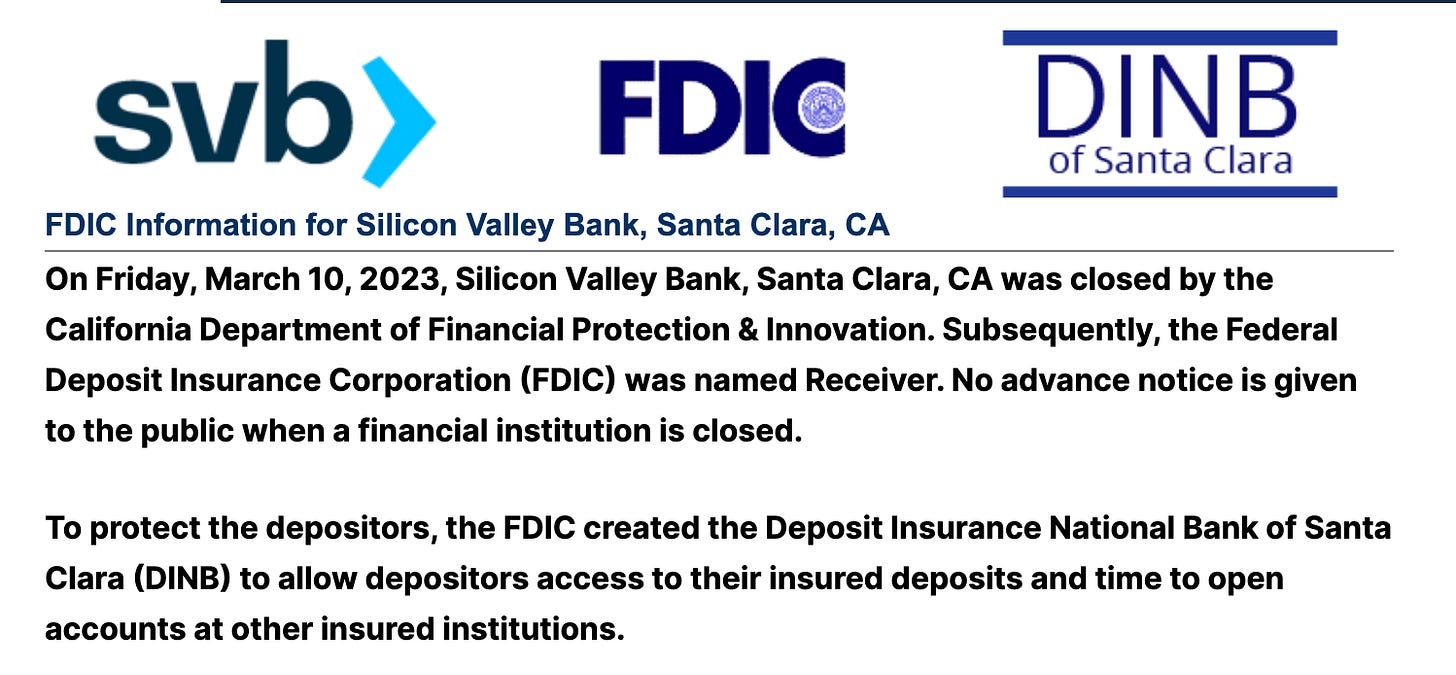

This run happened so fast, that government regulators literally had to shut down the bank mid-day on Friday because the bank had no money. They were in shortfall and a free fall.

Here is the thing. The big idea that Jill and I had yesterday. Could this scenario play out in other banks? One thing we know about big businesses is that they mimic best solutions from each other. Have other banks also used long-term bonds and no-interest accounts to store money that they couldn’t lend to clients as easily as before? What happens next week when investors start questioning their bank’s investing practices? Will they discover banks across America have a short-fall?

Where will investors and companies store their money? Stocks and bonds are the easy answer, but not likely because one can not pay payroll and overhead from stocks and bond accounts. Companies have to use banks for that. So, banks that can show a positive balance sheet is what the smart consumer will be searching for.

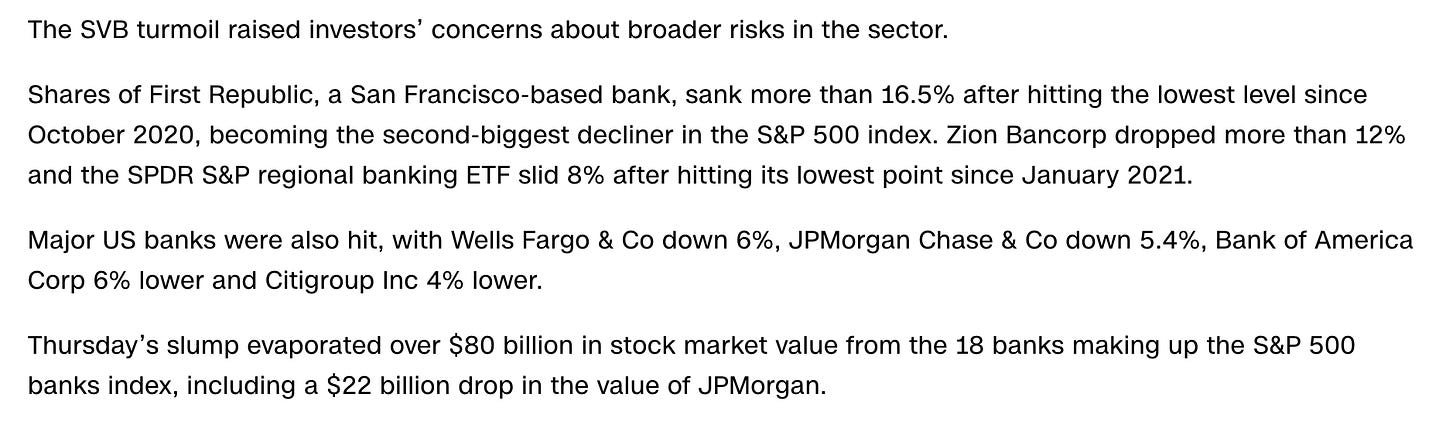

Silicon Valley bank is mostly a commercial bank - with 95% of their loans/clients having accounts larger than $250,000. - so these funds are not insured by the US government. Tomorrow morning, all those Silicon Vally bank clients, those large and small companies that can’t get their money out will not be able to make payroll, pay overhead, etc. This means everyday Americans will not get paid. It means they will be scrambling for loans - in a market where all of a sudden, money will be tight - as other banks will be fearful of a run. Banking stocks are already taking a hit.

This means Monday morning, there is good chance all hell will break lose in the financial and tech markets.

Stay tuned, if the Feds don’t get ahead of this - things could get ugly quick.

I am sure that the Feds will be taking the “too big to fail” solution that they used in 2008. That solution means the tax payer will be eventual payer for this bank’s mistake and big tech’s pay roll problems and shortfalls.

Questions remain. Is Silicon Valley Bank too big to fail? If it is allowed to fail, will other banks follow suit? If it is bailed out, does this set a precedent for the future bail outs, if other banks fail? Finally, when does the Feds “habit” of printing money to cover items such as pandemic loans, wars and short-falls catch up to all of us?

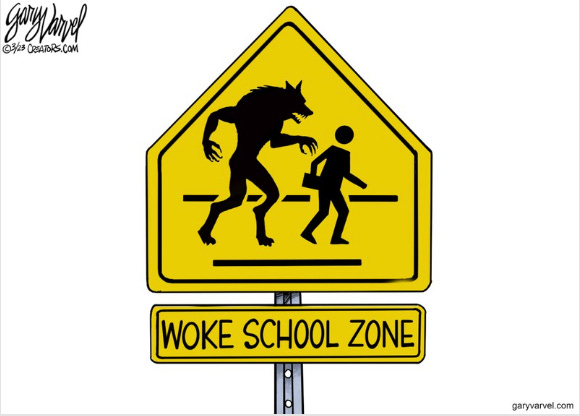

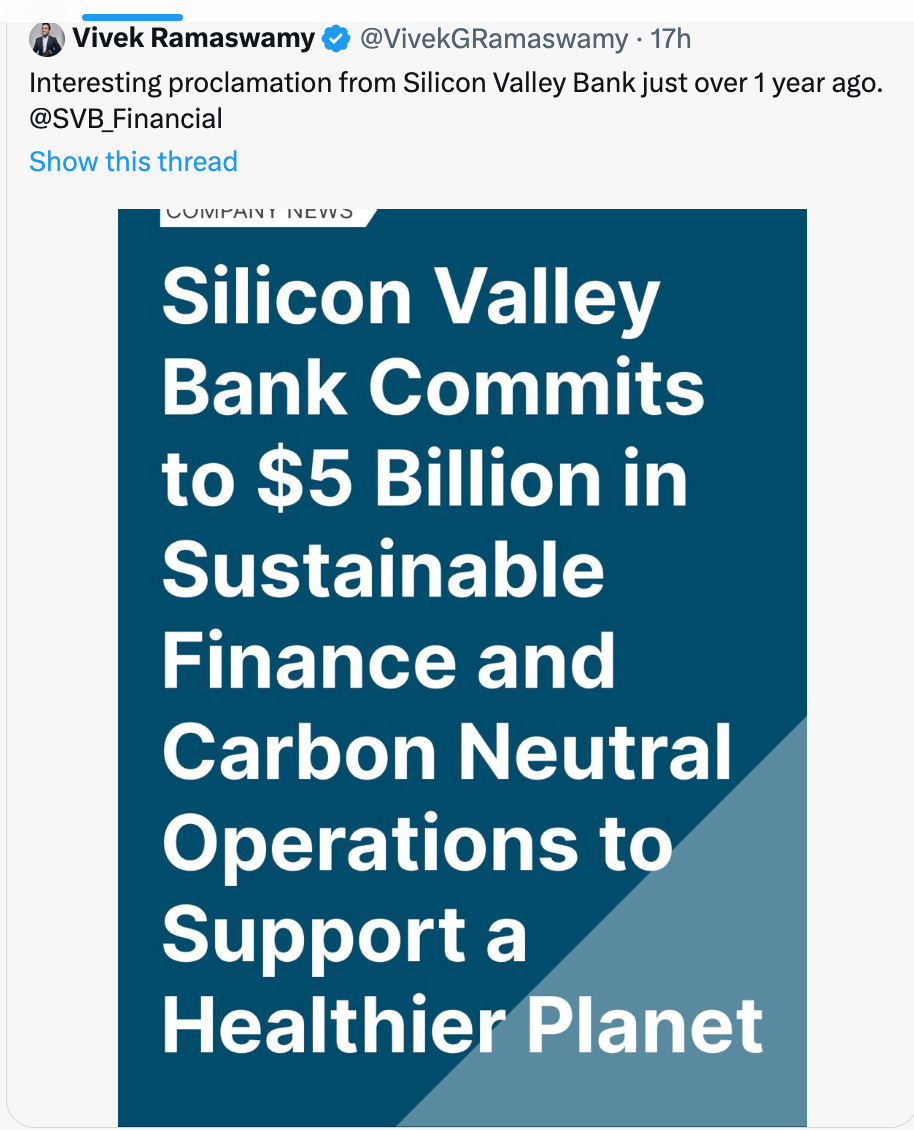

Seems like maybe Silicon Valley Bank was too worried about this…

And not worried enough about this:

Of course, in response - the Feds expressed “full confidence” in banking regulators to make things right.

The Treasury Department said Secretary Janet Yellen discussed the situation at a meeting she convened with financial regulators.

"Secretary Yellen expressed full confidence in banking regulators to take appropriate actions in response and noted that the banking system remains resilient and regulators have effective tools to address this type of event,"

Yeh, let’s see how that works out for everyday Americans.

I am not posting a comedy video today - because I think the topic of avian intelligence super intriguing. We have had a lot of birds over the years and I am still just fascinated by them.

IMO: They are as close to understanding the mind of the dinosaur as we will get.

Dr. Malone, the Bank bought those treasuries while the White House was telling them that inflation was transitory. The Bank bought that hook, line & as of Friday, sinker!

Real fear of our bureaucrat's record of ignoring the obvious, might be warranted. SVB, FTX, Madoff, Enron, Covid relief fraud, Trillion's to lose an unnecessary war, funding gain of function, 0% interest for too long …the list appears infinite and too painful to accept.